Claims Technology

Every year in the UK, hundreds of thousands of road accidents occur. 53% of commercial motor claims are reported by the third party rather than the insured, often leading to higher costs and delays.

In many instances it can take over 10 days to report an accident, giving third parties the upper hand. During this time, car hire charges can quickly escalate, significantly increasing claim costs when another insurer is footing the bill.

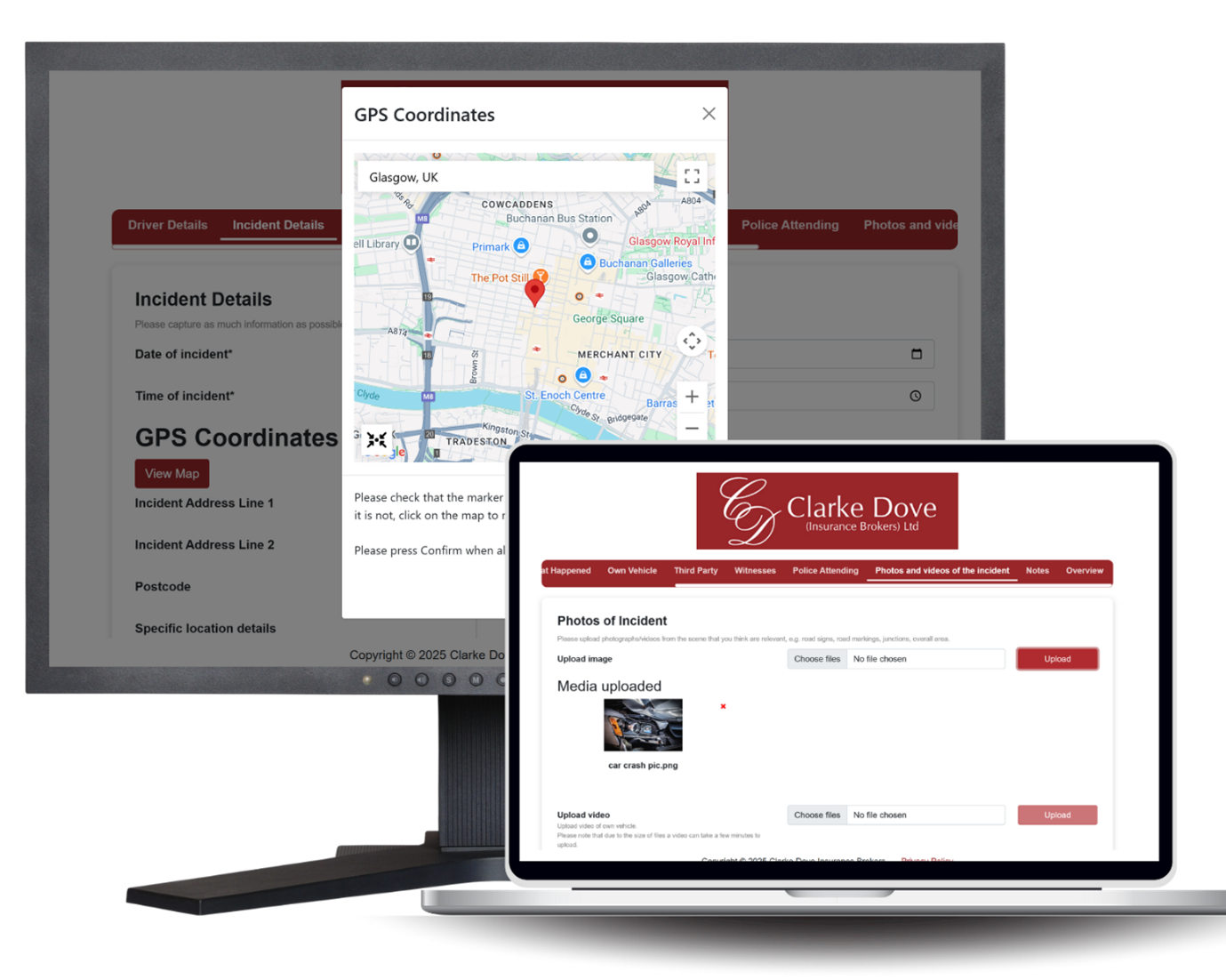

That’s where the Clarke Dove webpage reporting portal comes in – a digital solution designed from the ground up to help transform claims reporting processes. Our portal addresses key insurance challenges to save both time and money.

By reporting claims quickly and directly, you can take back control, reduce costs, and speed up resolutions.

How it Works?

Our technology is simple and easy for everyone to use…

Compatible on both desktop and mobile devices, the portal can be used by both drivers and Transport Managers to report claims.

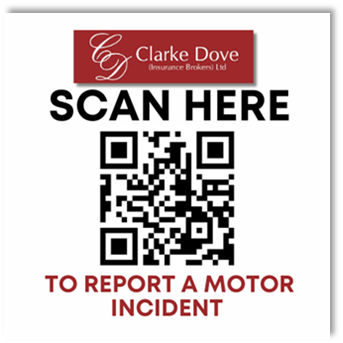

Should an incident, click the webpage reporting portal link here (https://manager.insureapps.co.uk/form/230/8) or scan the Clarke Dove QR Code below.

Follow the on-screen instructions to report your claim and capture key information such as:

- GPS Location

- Photographs + video footage

- Witness Details

- Own Vehicle Details

- Third Party Details + More!Once completed, the report is automatically submitted to the Clarke Dove claims team, ensuring a fast and efficient claims experience.

QR Code stickers can be stuck in the vehicles cabin. When an incident occurs, the driver will simply scan the QR code to access the reporting portal.

The Benefits

Driver Guidance and Increased Accuracy

Being involved in an incident can be stressful for those involved. People forget what to do and ultimately important insurance information is missed.

Our technology addresses this challenge by guiding users through the reporting process, step-by-step.

Users are less likely to forget what key information to capture at the roadside. In fact, Insure Apps capture witness details 3x more than the industry average

Improved Reporting Times

Users can report claims anytime, anywhere. They do not need to adhere to business hours or wait on hold. The user simply opens the reporting portal on their device and can submit the claim in minutes.

The Results? Significant improvements in First Notification of Loss (FNOL) reporting times. Insure Apps clients have a day one reporting average of 82.2%.

Saving Costs

Every delayed claim costs more than just repair fees. Uninsured losses, costly credit hire charges, admin charges, and increased future premiums can quickly add up.

By improving FNOL, on average, claims reported using Insure Apps technology can save 20% in claims costs per claim

Don’t let traditional methods claims reporting slow you down, embrace the webpage reporting portal today and save valuable time and money. A webpage reporting portal is not just a convenience—it’s a cost-saving investment.

Get in touch with the Clarke Dove team today to find out how your business can start digitally reporting claims